Finance Teams Reducing Errors with Guided HubSpot Onboarding

Picture a finance manager at a Sydney company staring at a difference report. Revenue numbers don’t match between HubSpot and the accounting system. Again.

After three days of checking, they find the problem. A simple field mapping error during HubSpot setup. One tiny mistake made six months ago has been creating errors ever since. Invoices sent to wrong addresses. Payment terms recorded incorrectly. Customer credit limits missing entirely.

The cleanup cost? Over $50,000 in staff time, delayed payments, and damaged client relationships.

This exact thing happens more often than you’d think. And it’s completely preventable with proper HubSpot onboarding.

Also Read: HubSpot Service Professional Supports That Aligns Sales & Marketing

Why Finance Teams Need Different Onboarding

Finance isn’t marketing. It’s not sales. The stakes are completely different. Marketing can test their way to success. Sales can try things and improve. Finance needs to get it right the first time.

One decimal point in the wrong place isn’t a learning chance. It’s a disaster waiting to happen.

The Finance Team Reality

Your finance people deal with money. Real money that needs to flow correctly between systems, customers, and bank accounts. They work with compliance rules, audit trails, and regulations that don’t care about your software learning curve.

Standard HubSpot onboarding focuses on marketing and sales use cases. Lead capture. Email campaigns. Deal stages. All important stuff, but not what keeps your CFO up at night.

Finance-focused HubSpot onboarding addresses completely different concerns. Data accuracy above everything else. Proper links with accounting systems. Automated workflows that maintain financial controls. Reporting that satisfies auditors.

The Cost of Getting It Wrong

Financial errors aren’t just embarrassing. They’re expensive. Really expensive.

Wrong invoice amounts damage customer trust. Incorrect payment terms hurt cash flow. Poor data quality makes forecasting unreliable. Integration failures create matching nightmares. Missing audit trails cause compliance headaches.

Each error costs money to fix. Multiple errors pile up into serious problems that take months to untangle.

What Makes HubSpot Onboarding Different from DIY Setup

YouTube tutorials and help articles make HubSpot look simple. Click here, enter that, done. Except finance operations aren’t simple, and mistakes cost real money.

The Hidden Complexity

HubSpot is powerful and flexible. That’s wonderful until you realize flexibility means a thousand different ways to set things up. Some approaches work brilliantly for finance operations. Others create problems that won’t show up until you’re deep into using the system.

Professional HubSpot onboarding guides you toward setups that actually work for financial operations. Not generic best practices. Specific setups that maintain data quality and support finance workflows.

Integration Gets Tricky Fast

Your finance team doesn’t work alone. They need HubSpot talking smoothly with accounting software like Xero or MYOB, payment gateways, banking systems, invoicing platforms, and reporting tools.

Each link has quirks. Data needs to flow correctly in both directions. Mapping fields between systems needs understanding both platforms deeply. One wrong connection and you’re creating errors automatically.

Guided onboarding handles this complexity properly. Your links work reliably from day one instead of becoming a source of constant frustration.

Compliance Isn’t Optional

Australian businesses face various financial reporting requirements. Privacy regulations. Tax obligations. Industry-specific rules. Your HubSpot setup needs to support compliance, not undermine it.

Professional onboarding makes sure you have proper audit trails, appropriate data retention, correct permission structures, and compliant reporting capabilities. These aren’t nice-to-haves. They’re requirements.

How Proper HubSpot Onboarding Reduces Finance Errors

Let’s get specific about how guided setup prevents costly mistakes.

Data Validation from the Start

Garbage in, garbage out. That old saying is especially true for finance data. Proper onboarding sets up validation rules that prevent bad data from entering your system.

Required fields for critical information. Format requirements for account numbers. Validation for ABN entries. Range checks for money amounts. These simple controls stop errors before they start.

Without guided setup, teams often skip validation thinking they’ll add it later. Later never comes, and bad data piles up.

Field Mapping That Makes Sense

When HubSpot connects to your accounting system, every field needs to map correctly. Customer name goes here. Invoice amount goes there. Payment terms map to this field. Tax treatment connects to that one.

Get one mapping wrong and every transaction carries that error forward. Professional onboarding maps fields carefully, tests thoroughly, and documents everything.

Your finance team knows exactly how data flows between systems and can troubleshoot confidently when questions arise.

Automated Workflows with Financial Controls

Automation is brilliant for finance teams. It removes manual data entry, makes sure processes stay consistent, and speeds up operations. But automation without proper controls creates systematic errors at scale.

Guided HubSpot onboarding builds automation with appropriate safeguards. Approval workflows for amounts above limits. Verification steps for critical transactions. Exception handling for unusual cases. Notifications when something needs manual review.

These controls maintain financial discipline while still delivering automation benefits.

Reporting That Finance Actually Trusts

Finance teams need reports they can trust absolutely. Board presentations. Management accounts. Cash flow forecasts. Audit documentation. One wrong number undermines confidence in everything.

Professional onboarding creates reporting structures that match finance requirements. Not marketing dashboards. Not sales metrics. Financial reports that match properly, support audit trails, and provide the specific insights finance teams actually need.

The Smartmates Approach to Finance-Focused HubSpot Onboarding

Here’s how we approach HubSpot onboarding differently for finance teams.

We Start with Financial Processes

Other onboarding services start with HubSpot features. We start with your financial processes. How do invoices get created? What approvals are required? How does payment processing work? What matching steps happen?

Understanding your finance operations comes first. Then we set up HubSpot to support those operations properly. Technology serves process, not the other way around.

We Focus on Data Accuracy

Finance teams can’t work with approximate data. Close enough isn’t good enough. Our onboarding approach focuses heavily on data accuracy. We test extensively. Verify thoroughly. Document completely.

Every link gets validated with real transactions. Every workflow gets tested with edge cases. Every report gets verified against source systems. Nothing goes live until we’re confident it’s correct.

We Build in Audit Trails

Auditors love clear trails showing who did what when and why. Good HubSpot onboarding creates these trails automatically. Change logs. Activity histories. Version tracking. Approval records.

When audit time comes, your finance team has complete documentation without extra work. The system creates records automatically as people work.

We Train for Financial Confidence

Generic HubSpot training teaches people where buttons are. Finance-focused training teaches people how to maintain accuracy, verify data quality, troubleshoot differences, and understand financial impacts of system actions.

Your finance team operates HubSpot confidently because they understand not just how to use it, but why it’s set up the way it is.

Before diving into any system setup, we begin with clarity. Every Smartmates onboarding project starts with a complimentary planning session, a focused discussion with our consultants to review your finance processes, priorities, and the best HubSpot approach for your business.

If you’re still exploring what you need, we offer a “Figure Out What I Need” package at a discounted $99/hr + GST (10-hour minimum). It’s a practical way to define your scope and avoid costly trial-and-error later.

And when you’re ready to move forward, your first project is billed at a special $119/hr + GST, capped at 25 hours. It’s an easy way to experience Smartmates’ onboarding quality with full transparency and no surprises.

Common Finance Errors Prevented by Proper Onboarding

Let’s look at specific problems that guided onboarding prevents.

Duplicate Customer Records

Duplicate records are annoying for marketing. For finance, they’re dangerous. Invoice sent to wrong record. Payment applied to duplicate account. Credit limits split across records. Customer history incomplete.

Proper onboarding puts in place rules to remove duplicates, merge procedures, and validation that prevents duplicates from being created. Your customer master data stays clean and reliable.

Incorrect Revenue Recognition

Revenue recognition rules matter. When you recognize revenue affects financial statements, tax obligations, and compliance. Getting it wrong isn’t an option.

Guided onboarding sets up deal stages, automation, and reporting that line up with your revenue recognition policies. The system supports correct accounting treatment automatically.

Missing Financial Information

Incomplete customer records cause problems downstream. Missing payment terms. No credit limit. Incorrect tax status. Each gap creates issues when invoices get created or payments need processing.

Professional onboarding makes critical fields required, sets up validation, and creates workflows that make sure complete information exists before financial processes begin.

Integration Sync Failures

When HubSpot and your accounting system fall out of sync, matching becomes a nightmare. Transactions exist in one system but not the other. Balances don’t match. Nobody’s sure which system is correct.

Proper onboarding includes error handling, sync monitoring, and automatic alerts when integration issues occur. Problems get caught and fixed immediately instead of piling up silently.

The HubSpot Onboarding Process for Finance Teams

Here’s what guided onboarding actually looks like for finance operations.

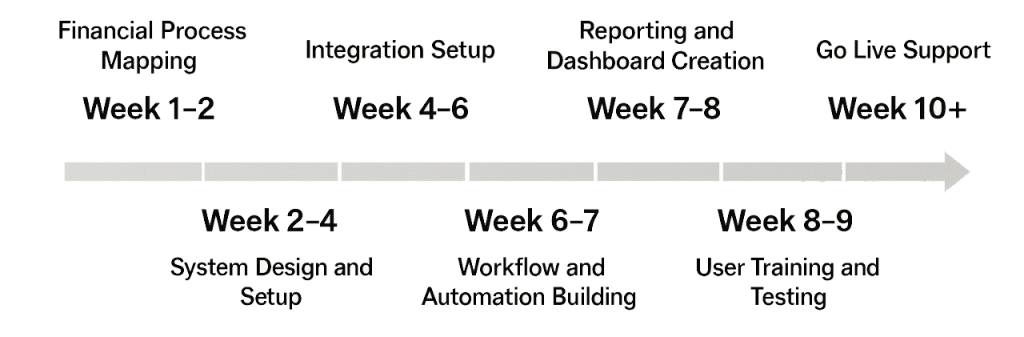

Phase 1: Financial Process Mapping (Week 1-2)

We document your current financial processes in detail. Customer onboarding and credit checks. Quote and proposal creation. Order processing and fulfillment. Invoicing and payment collection. Revenue recognition and reporting. Month-end and quarter-end close.

This mapping identifies exactly what HubSpot needs to support. We find integration points, approval requirements, control needs, and reporting demands.

Nothing gets set up until we thoroughly understand your finance operations.

Phase 2: System Design and Setup (Week 2-4)

Based on process mapping, we design your HubSpot setup. Custom properties for financial data. Pipeline stages matching your revenue recognition. Workflows supporting financial controls. Integration architecture connecting systems properly.

You review and approve designs before work begins. This makes sure we’re aligned and prevents surprises.

Phase 3: Integration Setup (Week 4-6)

Now we connect HubSpot with your accounting system and other financial tools. Field mapping between systems. Sync rules and timing. Error handling and monitoring. Test transactions to verify accuracy.

Integration testing is extensive because errors here multiply across every transaction.

Phase 4: Workflow and Automation Building (Week 6-7)

With integrations solid, we build automation that supports your financial processes. Approval routing based on transaction amounts. Automated invoice creation and sending. Payment reminder sequences. Escalation workflows for overdue accounts. Exception handling for unusual cases.

Each workflow includes appropriate controls and audit trails.

Phase 5: Reporting and Dashboard Creation (Week 7-8)

Finance needs specific reports and dashboards. We build them carefully. Aged receivables reports. Revenue forecasts. Customer payment history. Cash flow projections. Outstanding invoice tracking. Collection efficiency metrics.

Every report gets validated against your accounting system to make sure it’s accurate.

Phase 6: User Training and Testing (Week 8-9)

Your finance team learns the system through hands-on training with real scenarios. We walk through complete processes end to end. Create test invoices. Process sample payments. Run matching reports.

Training continues until everyone’s comfortable and confident.

Phase 7: Go Live Support (Week 10+)

Launch day gets intensive support. We monitor closely as real transactions flow through the system. Quick responses to questions. Immediate fixes for any issues. Regular check-ins to make sure everything’s working smoothly.

Support continues for several weeks after launch because questions always arise with actual use.

Integration Considerations for Australian Finance Teams

Australian businesses have specific integration needs that onboarding must address.

Xero and MYOB Integration

Most Australian SMEs use Xero or MYOB for accounting. HubSpot needs to link smoothly with whichever platform you use. Customer records sync both ways. Invoices flow from HubSpot to accounting. Payment information updates back to HubSpot. GST handling works correctly.

Professional onboarding sets up these links properly for Australian tax and reporting requirements.

Payment Gateway Connections

If you process payments through gateways like Stripe or PayPal, those need connecting to HubSpot. Payment status updates automatically. Receipt creation happens correctly. Failed payment handling works properly.

These connections need careful setup to maintain financial accuracy.

Banking System Links

Some businesses need HubSpot connecting to banking systems for payment matching. Transaction matching. Bank feed processing. Direct debit management.

These links are complex and benefit hugely from expert guidance.

Reporting Platform Connections

Finance teams often use special reporting tools beyond HubSpot’s native capabilities. Power BI, Tableau, or custom dashboards need HubSpot data flowing to them correctly.

Proper onboarding makes sure data feeds are structured appropriately for your reporting needs.

Common Mistakes Finance Teams Make Without Guidance

Let’s talk about what goes wrong when finance teams try HubSpot setup without proper onboarding.

Treating It Like a Marketing Tool

HubSpot started as a marketing platform. Many tutorials and resources still focus heavily on marketing use cases. Finance teams following marketing-focused guidance end up with setups that don’t support financial operations properly.

Guided onboarding approaches HubSpot from a finance perspective from day one.

Skipping Data Validation Setup

Setting up validation rules feels tedious during setup. Teams skip it planning to add validation later once the system is running. Later never comes, and bad data piles up.

Professional onboarding insists on validation from the start. Short-term extra effort prevents long-term data quality problems.

Underestimating Integration Complexity

Finance teams see that HubSpot offers integration with their accounting software and assume it’s plug and play. It rarely is. Field mapping, sync timing, error handling, and testing all need careful attention.

Without guidance, teams often launch links that look like they’re working but actually contain subtle errors that pile up over time.

Ignoring Change Management

New systems need process changes. Finance teams are often conservative about changes because errors have serious results. Without proper change management during onboarding, adoption suffers.

Guided onboarding includes change management as a core part. We help teams understand why changes benefit them and support the transition.

Why Australian Finance Teams Choose Smartmates

Finance teams across Australia trust Smartmates for HubSpot onboarding because we understand both HubSpot and financial operations.

We Speak Both Languages

Our team includes people with finance backgrounds and HubSpot expertise. We understand your accounting terms, financial processes, and compliance needs. We also know HubSpot inside and out.

That combination is rare and valuable.

We’re Certified and Current

Smartmates holds official HubSpot certifications and stays current with platform updates. Finance requirements change. Accounting standards change. HubSpot releases new features. We stay on top of all of it.

Your onboarding reflects current best practices and capabilities.

We Focus on Australian Requirements

We understand Australian financial reporting, GST handling, payment systems, and regulatory environment. Your HubSpot setup works properly for Australian finance operations, not some generic international setup.

We Provide Ongoing Support

Finance operations don’t stop after go-live. Questions arise. Processes change. New requirements emerge. We’re there for ongoing support as your needs change.

Setup is just the beginning of our partnership.

The ROI of Professional HubSpot Onboarding for Finance

Let’s talk about the financial return on investing in proper onboarding.

Error Reduction Savings

Every financial error costs money to fix. Staff time checking. Corrections and adjustments. Customer service managing complaints. Even small reductions in error rates deliver big savings.

If your finance team of four people spends just 5 hours weekly fixing preventable errors, that’s over 1,000 hours annually. At typical finance salary levels, proper onboarding pays for itself in error reduction alone.

Efficiency Gains

Automated workflows save time on every transaction. Better integration reduces matching effort. Cleaner data speeds up reporting. These efficiency gains add up quickly.

Finance teams often save 10-15 hours weekly through properly set up HubSpot automation. That’s meaningful capacity freed for higher-value work.

Improved Cash Flow

Faster, more accurate invoicing improves cash collection. Better payment tracking reduces overdue accounts. Automated reminders increase payment compliance.

Reducing days sales outstanding by even 5-7 days can free up substantial working capital. For many businesses, this alone justifies the onboarding investment.

Reduced Risk

Financial errors create business risk. Compliance problems. Audit issues. Customer disputes. Reputation damage. Proper onboarding reduces these risks substantially.

The value of risk reduction is hard to measure precisely but very real.

Special Considerations for Growing Finance Teams

If your finance team is scaling along with your business, onboarding becomes even more critical.

Building Scalable Processes

What works for processing 50 invoices monthly breaks down at 500 invoices. Proper onboarding builds processes that scale smoothly as volume increases.

You don’t want to rebuild your HubSpot setup every six months as you grow. Get it right once and scale smoothly.

Training New Finance Staff

With proper onboarding, your HubSpot setup is documented and understandable. New finance staff can learn the system quickly because it’s organized logically and supported by clear documentation.

Without good onboarding, knowledge lives in people’s heads. When they leave, that knowledge goes with them.

Maintaining Controls at Scale

Financial controls matter even more as transaction volume increases. Proper onboarding builds controls that work at any scale. Approval workflows. Separation of duties. Exception reporting. Risk monitoring.

These controls protect your business as it grows.

Transform Your Finance Operations with Proper Onboarding

Your finance team deserves tools that support accuracy, efficiency, and control. HubSpot can deliver all of that, but only when set up properly for financial operations.

Generic onboarding creates generic results. Finance-focused onboarding creates systems that finance teams actually trust and use confidently.

Smartmates focuses on HubSpot onboarding for Australian finance teams. We understand both the platform and financial operations. We set up systems that maintain data accuracy, support compliance, link smoothly, and enable efficiency without sacrificing control.

Ready to reduce finance errors and improve work efficiency?

Contact Smartmates today to discuss finance-focused HubSpot onboarding. Let’s build a system your finance team can trust absolutely. One that removes preventable errors, automates routine tasks, and provides the accurate data and reporting your financial operations require.

Your finance team is too important to risk with amateur setup. They deserve professional onboarding that gets HubSpot right from the start.

Let’s transform your finance operations together. Error-free, efficient, and built to scale.

Request a Callback from Smartmates

Sarah

I’ll listen to your HubSpot needs to understand your business challenges and goals, ensuring a tailored approach.

I’ll bring our engineer onto our first consultation to explore solutions and clarify your requirements.

We’ll deliver your free project plan quotation, detailing the steps, timeline, and costs—up to this point, it’s completely free!

“My mission is to solve your key problems, build your trust in our capabilities and deliver exceptional value for money.”